We bank on women to raise the next generation, we bank on women to balance family responsibility with career or entrepreneurial demands, we bank on women to carry a double (or triple) burden with ease and grace, but we don't bank on women to be viable consumers of finance.

Only 26% of women in India have an account with a formal financial institution, as compared with 46% of men. Less than 15% of women entrepreneurs in India have access to finance from a formal banking institution.

Despite India leading the way, with prominent banks in both the public and private sector being headed by women, access to finance for women in India has remained low. Is it that we don't bank on women, or is it that they don't bank on financial institutions as approachable or relevant? Perhaps it is just a question of semantics and the blame lies on both sides. It is important to take a moment to say that this gap in finance is consequential but not a deliberate exclusion.

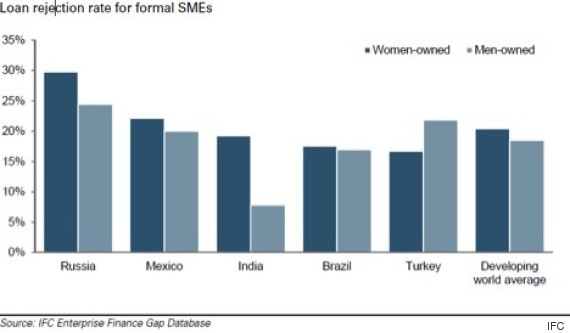

While banks do not deliberately exclude women, something in the system is not working. A Goldman Sachs Global Investment Research Report that looked at loan rejection rates for small and medium enterprises (SMEs) found that rejection rates for women-owned SMEs in India were almost double than those owned by men. It is a much higher rate than other countries in the world, so something, somewhere isn't working and needs to be fixed.

![loan rejection graph]()

Women actually make 'good banking customers' and studies across the world show that women customers have many positive characteristics including lower risk behaviour that leads to higher profitability for a bank and better retention rates. Women tend to have deeper relationships with their financial institutions, allowing banks to cross sell additional products and services to them with much more success than to their male clients. Women tend to favour relationship banking and have fewer banking relationships, often preferring to meet their financial needs from one institution.

These financial needs can include personal current and savings accounts, business accounts (working capital loans, lease finance and equity capital) insurance, home loans, and family-related finance, including student loans. This non-inclusion is also not a monopoly of India, and we see that developed economies face similar issues with a lower number of women consuming financial services from formal institutions than men.

There are measures increasingly being put in place in India that should make us feel optimistic towards increased banking on women. The government's focus on financial inclusion, Pradhan Mantri Jan Dhan Yojana, is one step that will positively contribute towards increased financial inclusion for women.

The government's recently launched Pradhan Mantri Mudra Yojana or Mudra scheme is another example. While the Mudra scheme is actually gender agnostic, it will have a much more significant impact on women entrepreneurs who have struggled with accessing finance due to a disproportional lack of collateral for decades in India. It is still early days and there are concerns with the scheme and the potential for non-performing loans (NPLs) to rise, but it is a significant step that will change the face of banking for women in India. It sends a message to the banking community to think differently about how to offer credit, products and services.

In this year of women in India (and internationally, with Beijing promises due) and the government of India's recognition of the important role of women in society and growth of the nation, can women and financial institutions finally find a crossroads where they meet to serve each other? Financial literacy for women is a key, but awareness for all of us will play a big role in addressing the gap. This article is a small step towards raising awareness and interest in this issue.

![]() Like Us On Facebook |

Like Us On Facebook |

![]() Follow Us On Twitter |

Follow Us On Twitter |

![]() Contact HuffPost India

Contact HuffPost India

Also see on HuffPost:

Only 26% of women in India have an account with a formal financial institution, as compared with 46% of men. Less than 15% of women entrepreneurs in India have access to finance from a formal banking institution.

Despite India leading the way, with prominent banks in both the public and private sector being headed by women, access to finance for women in India has remained low. Is it that we don't bank on women, or is it that they don't bank on financial institutions as approachable or relevant? Perhaps it is just a question of semantics and the blame lies on both sides. It is important to take a moment to say that this gap in finance is consequential but not a deliberate exclusion.

While banks do not deliberately exclude women, something in the system is not working. A Goldman Sachs Global Investment Research Report that looked at loan rejection rates for small and medium enterprises (SMEs) found that rejection rates for women-owned SMEs in India were almost double than those owned by men. It is a much higher rate than other countries in the world, so something, somewhere isn't working and needs to be fixed.

Women actually make 'good banking customers' and studies across the world show that women customers have many positive characteristics including lower risk behaviour that leads to higher profitability for a bank and better retention rates. Women tend to have deeper relationships with their financial institutions, allowing banks to cross sell additional products and services to them with much more success than to their male clients. Women tend to favour relationship banking and have fewer banking relationships, often preferring to meet their financial needs from one institution.

These financial needs can include personal current and savings accounts, business accounts (working capital loans, lease finance and equity capital) insurance, home loans, and family-related finance, including student loans. This non-inclusion is also not a monopoly of India, and we see that developed economies face similar issues with a lower number of women consuming financial services from formal institutions than men.

There are measures increasingly being put in place in India that should make us feel optimistic towards increased banking on women. The government's focus on financial inclusion, Pradhan Mantri Jan Dhan Yojana, is one step that will positively contribute towards increased financial inclusion for women.

The government's recently launched Pradhan Mantri Mudra Yojana or Mudra scheme is another example. While the Mudra scheme is actually gender agnostic, it will have a much more significant impact on women entrepreneurs who have struggled with accessing finance due to a disproportional lack of collateral for decades in India. It is still early days and there are concerns with the scheme and the potential for non-performing loans (NPLs) to rise, but it is a significant step that will change the face of banking for women in India. It sends a message to the banking community to think differently about how to offer credit, products and services.

In this year of women in India (and internationally, with Beijing promises due) and the government of India's recognition of the important role of women in society and growth of the nation, can women and financial institutions finally find a crossroads where they meet to serve each other? Financial literacy for women is a key, but awareness for all of us will play a big role in addressing the gap. This article is a small step towards raising awareness and interest in this issue.

Like Us On Facebook |

Like Us On Facebook |  Follow Us On Twitter |

Follow Us On Twitter | Also see on HuffPost: