The Goods and Services Tax (GST) proposed to be introduced in India has been designed as a destination-based consumption tax which proposes a unified tax structure for the entire country. Since this taxation regime would cover the length and breadth of the nation, it is essential that a robust IT infrastructure is put in place as the spinal cord for a successful GST rollout.

The GST is being proposed on a dual level. The Central Goods and Service Tax (CGST) and State Goods and Service Tax (SGST) will be simultaneously levied by the Union and state governments on the supply of goods and services. The Integrated GST (IGST), which is a combination of CGST and SGST, is proposed to be levied on imports / inter-state supply of goods and services. The IGST will be levied by the Union government with the SGST portion transferred to the destination state. Binding this entire fabric together is a system of input credits, which basically allows the taxpayer to take credit of the taxes paid on procurement, within a certain order and nexus, to offset taxes liable on his output.

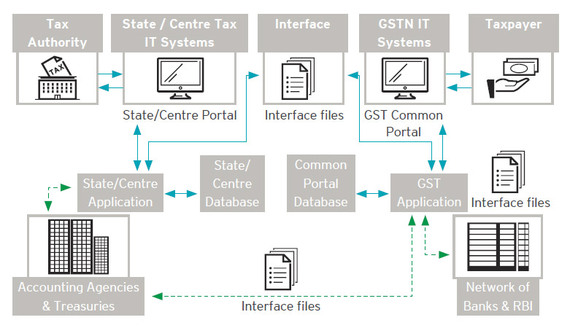

Image courtesy: www.ey.com/

![2016-05-25-1464162493-6794303-eyindiataxinsightsimg4.jpg]()

The Empowered Committee of State Finance Ministers first set up an Empowered Group on IT infrastructure for GST headed by Mr Nandan Nilekani on 26 July 2010. In March 2013, the Goods and Service Tax Network (GSTN) --a Section 25 (not for profit), non-government, private limited company -- was established for providing the proposed IT infrastructure for the GST rollout in conjunction with the state and central tax administrations. The Government of India holds 24.5% equity in GSTN and all states of the Indian Union, including the NCT of Delhi and Pondicherry, and the Empowered Committee of State Finance Ministers (EC), together hold another 24.5%. The balance 51% equity is held by non-government financial institutions such as ICICI, HDFC Limited etc. Moving forward, the GSTN on the basis of a Request for Proposal (RFP), has now awarded a contract worth ₹1380 crore to Infosys Technologies to build a system which will be the IT interface for implementing the GST. This interface will take care of harnessing the entire input credit system, the Permanent Account Number (PAN)-based registrations, compliance requirements, tax payments etc and will be the nerve centre for the entire GST levy. This contract is for five years post the GST implementation.

What are the challenges that must be addressed by this proposed IT infrastructure? At the outset, the system will have to be connected to the tax systems of each state government, the central government, the Reserve Bank and other banks and the Central Board of Excise and Customs (CBEC). The infrastructure must also be capable of exchanging information with the IT systems of the Income Tax Department (PAN), The Ministry of Company Affairs (incorporation data) and the Indian Customs (to regulate import/export) to name a few. The main challenge for the system will be the capture of the input credit data to enable the cross credit across the tax fabric for registered dealers. Also, since part of the IGST will have to be credited to the states by the Centre, a seamless integration will be needed between the state IT infrastructure, the Reserve Bank and the Central Revenue dispensation department.

On the state side, it is very important that the IT system proposed captures the taxpayer data correctly, including but not limited to registrations, sales/purchase records, tax assessments, refunds, ledgers, litigation in progress etc. Special focus needs to be trained on capturing invoice data which is akin to a 'promissory note', on the basis of which tax credits will be eligible to any taxpayer. The taxpayer/dealer would also be required to revamp their internal systems to match the IT infrastructure and maintain proper ledger records and ERP/MIS Master Data.

The GSTN has been working with the states to pilot the project and make them ready to meet these challenges. Some states like Karnataka and Maharashtra have very sophisticated systems while other smaller ones have very rudimentary IT infrastructure. The GSTN has offered to help 12 states, including Bihar, Orissa, the North Eastern States and Himachal Pradesh, to set up their backend systems to match the technical capabilities required. Some states, such as Punjab, Haryana and Tamil Nadu, are building their own systems to obtain critical mass.

![2016-05-25-1464162602-7497057-PictweetGSTNetwork.jpg]()

The challenges in getting this massive project online are enormous, especially in a country which is not known to have a seamlessly operating tax IT structure. It is important that the small states get their systems working efficiently to ultimately integrate with the mothership. If the state infrastructure lags behind, no amount of technical efficiency in the backbone will suffice to bind the fabric together. Industry must also take appropriate measures to train themselves and their vendors to adapt to the infrastructure. In the absence of these bonds, the effective implementation of the GST law will remain a mirage to the taxpayer.

![]() Like Us On Facebook |

Like Us On Facebook |

![]() Follow Us On Twitter |

Follow Us On Twitter |

![]() Contact HuffPost India

Contact HuffPost India

Also see on HuffPost:

The GST is being proposed on a dual level. The Central Goods and Service Tax (CGST) and State Goods and Service Tax (SGST) will be simultaneously levied by the Union and state governments on the supply of goods and services. The Integrated GST (IGST), which is a combination of CGST and SGST, is proposed to be levied on imports / inter-state supply of goods and services. The IGST will be levied by the Union government with the SGST portion transferred to the destination state. Binding this entire fabric together is a system of input credits, which basically allows the taxpayer to take credit of the taxes paid on procurement, within a certain order and nexus, to offset taxes liable on his output.

The [IT] system will have to be connected to the tax systems of each state government, the central government, the Reserve Bank and other banks and the CBEC.

Image courtesy: www.ey.com/

The Empowered Committee of State Finance Ministers first set up an Empowered Group on IT infrastructure for GST headed by Mr Nandan Nilekani on 26 July 2010. In March 2013, the Goods and Service Tax Network (GSTN) --a Section 25 (not for profit), non-government, private limited company -- was established for providing the proposed IT infrastructure for the GST rollout in conjunction with the state and central tax administrations. The Government of India holds 24.5% equity in GSTN and all states of the Indian Union, including the NCT of Delhi and Pondicherry, and the Empowered Committee of State Finance Ministers (EC), together hold another 24.5%. The balance 51% equity is held by non-government financial institutions such as ICICI, HDFC Limited etc. Moving forward, the GSTN on the basis of a Request for Proposal (RFP), has now awarded a contract worth ₹1380 crore to Infosys Technologies to build a system which will be the IT interface for implementing the GST. This interface will take care of harnessing the entire input credit system, the Permanent Account Number (PAN)-based registrations, compliance requirements, tax payments etc and will be the nerve centre for the entire GST levy. This contract is for five years post the GST implementation.

On the state side, it is very important that the IT system proposed captures the taxpayer data correctly... registrations, sales/purchase records, tax assessments, refunds, ledgers, litigation in progress etc.

What are the challenges that must be addressed by this proposed IT infrastructure? At the outset, the system will have to be connected to the tax systems of each state government, the central government, the Reserve Bank and other banks and the Central Board of Excise and Customs (CBEC). The infrastructure must also be capable of exchanging information with the IT systems of the Income Tax Department (PAN), The Ministry of Company Affairs (incorporation data) and the Indian Customs (to regulate import/export) to name a few. The main challenge for the system will be the capture of the input credit data to enable the cross credit across the tax fabric for registered dealers. Also, since part of the IGST will have to be credited to the states by the Centre, a seamless integration will be needed between the state IT infrastructure, the Reserve Bank and the Central Revenue dispensation department.

On the state side, it is very important that the IT system proposed captures the taxpayer data correctly, including but not limited to registrations, sales/purchase records, tax assessments, refunds, ledgers, litigation in progress etc. Special focus needs to be trained on capturing invoice data which is akin to a 'promissory note', on the basis of which tax credits will be eligible to any taxpayer. The taxpayer/dealer would also be required to revamp their internal systems to match the IT infrastructure and maintain proper ledger records and ERP/MIS Master Data.

It is important that the small states get their systems working efficiently to ultimately integrate with the mothership.

The GSTN has been working with the states to pilot the project and make them ready to meet these challenges. Some states like Karnataka and Maharashtra have very sophisticated systems while other smaller ones have very rudimentary IT infrastructure. The GSTN has offered to help 12 states, including Bihar, Orissa, the North Eastern States and Himachal Pradesh, to set up their backend systems to match the technical capabilities required. Some states, such as Punjab, Haryana and Tamil Nadu, are building their own systems to obtain critical mass.

The challenges in getting this massive project online are enormous, especially in a country which is not known to have a seamlessly operating tax IT structure. It is important that the small states get their systems working efficiently to ultimately integrate with the mothership. If the state infrastructure lags behind, no amount of technical efficiency in the backbone will suffice to bind the fabric together. Industry must also take appropriate measures to train themselves and their vendors to adapt to the infrastructure. In the absence of these bonds, the effective implementation of the GST law will remain a mirage to the taxpayer.

Like Us On Facebook |

Like Us On Facebook |  Follow Us On Twitter |

Follow Us On Twitter | Also see on HuffPost: