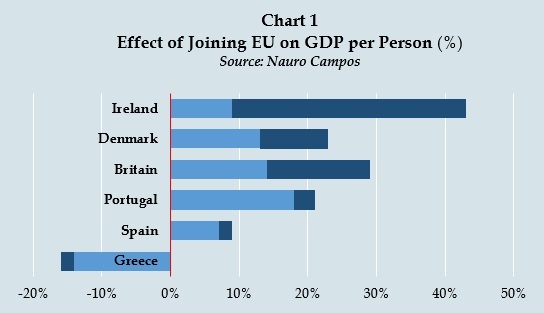

On 23 June 2016, Britons will vote on whether the country should exit the 28-member European Union (EU). Tax-free trading with other member countries, free mobility of citizens within EU, usage of a common currency (Euro) by most member countries, and a proper conflict resolution mechanism are some of the benefits that EU members enjoy. All this has resulted in economic prosperity for the major European countries, as is visible in Chart 1.

However, many Britons believe that their economic progress is being stymied by their membership to the EU and think that the rules they must adhere to are too constraining.

While the verdict of referendum could go either way, an exit from EU does have political, social, and economic implications, for both the EU and the UK.

Within these economic implications, let's analyse some of the impacts the Brexit may have on the country's e-commerce market:

Decline in purchasing power

Post a decision to separate from the EU, the UK will have a two-year time frame as per Article 50 to negotiate its terms of exit with the EU. This period is expected to be marred with uncertainty till the final trade agreements are announced. As a result, financial markets and exchange rate are expected to see increased fluctuations; a greater component of risk is likely in the credit and equity markets; and a dip is possible in business confidence and investment.

If Britain exits, the uncertainty in the market will reduce the customer's purchasing power... with a fall of 15%-20% in the valuation of the pound.

If Britain exits, the uncertainty in the market will reduce the customer's purchasing power -- as explained in The Guardian, the country will witness a fall of 15%-20% in the valuation of the pound.

Slowdown in British e-commerce and price rise across Europe

Although the contribution of the EU in the UK's total exports has reduced from 55% in 1999 to 45% in 2014, it is still the single largest market for the UK (Chart 4).

Within this tariff-free trade setup, the UK accounts for one-tenth of EU exports. As an EU member, FDI inflow in the UK has steadily increased, peaking at EUR 1 trillion in 2014.

At an overall trade level, a Brexit could result in increased tariff & non-tariff barriers (NTBs) for the UK while trading with the EU. This will specifically impact the country's e-commerce market -- worth over GBP 115 million in 2015 --across Europe.

Changes in tax structure will impact the tariff of both the goods exported as well as imported (the latter is in surplus) by the UK.

At present, the UK's e-commerce exports to Western European markets account for over 50% of total UK exports. Of this, France with a 24% share is the biggest importer of UK's e-commerce exports within EU, followed by Germany with 14% share. While it is expected that UK may still negotiate the continuation of the Free Trade Agreement (FTA), should that not happen, changes in tax structure will, in turn, impact the tariff of both the goods exported as well as imported (the latter is in surplus) by the UK. Online shoppers in and outside of the UK will end up paying more for a product (in the range of 2% to 15% higher, depending on the product category) because of this change in tariff structure. The continent's fashion e-commerce market, which traditionally includes price-sensitive customers, is expected to be hit the hardest in the ensuing phase and has already witnessed a 1% decline after the Brexit discussions picked up pace, signalling that consumers may be already changing their behaviour. While price increase is expected to stabilize in the long run, as a result of UK sourcing goods from cheaper markets, virtual retail companies will face challenges in the short term.

As elucidated in this article in Business Insider, Brexit could also have a detrimental impact on investments in the country, especially in the e-commerce sector, which traditionally has a high cash burn rate. Investors may associate the capital flow restriction from the UK to EU member states with a lower return on investment. This in turn may result in investors adopting the "hold" mind-set when it comes to business funding, thereby affecting the growth plans of several small to mid-sized e-commerce companies in the region.

In addition to their operating location, e-commerce companies in the region will have to rethink their sourcing policies and modify their pricing models to ensure business viability.

Practical constraints

Robert M.Maier Co-Founder of Visual Meta which runs e-commerce platforms across 20 countries in the name of Shopalike says

If the UK decides to leave the EU, online shoppers can expect delayed delivery and higher shipping costs of their products as most companies will still be working out the economics of operating from the UK. In addition e-commerce companies in the region will have to rethink their sourcing policies and modify their pricing models to ensure business viability. All these are expected to have a cumulative impact in the short term.

***

In conclusion, the impact of a Brexit is expected to be detrimental in the short-term for the e-commerce business. Changes in tax structure will impact prices for companies and customers, fluctuating financial markets will limit the funding options of companies, and uncertainty regarding new policies will affect product delivery time and costs. However, this uncertainty is expected to stabilize in the long term.

Like Us On Facebook |

Like Us On Facebook |  Follow Us On Twitter |

Follow Us On Twitter | Also see on HuffPost: